The itCraft Series: Product/Market Fit. Part 2: Market

Jakub Oleksy

Alexa Trachim

It’s time for the next episode of our product/market fit series. In the intro post, we explained the idea behind these articles and introduced you to the subject. Part one was all about the product: how it can be defined, built and promoted. Today we will focus on the second part of the magical formula we are focusing on and talk about the market.

Table of contents

1. What is the market?2. Market sizing

– Ask yourself what your target market is

– Evaluate the level of interest

– Estimate the potential profit

3. The Value Net Model

4. Market segmentation

5. Summary

You will find out how to determine the size of your potential market, prepare market segmentation and define key players crucial for your product’s success. Let’s jump right in!

What is the market?

The broad definition of the market comes from economical background. Check it out:

“The term ‘market’ as used by economists has a different meaning from ordinary usage. It does not mean literally the physical place in which commodities are sold or purchased (as in ‘village market’), nor does it mean the stages that a commodity passes through between the producer and the consumer (as in marketing channels). Rather it refers in an abstract way to the purchase and sale transactions of a commodity and the formation of its price. Used in this way, the term refers to the countless decisions made by producers of a commodity (the supply side of the market) and consumers of a commodity (the demand side of the market), which taken together determine the price level of the commodity.”

As you can see, the word “market” can have multiple meanings. There are various markets, including online and offline ones. Not every product is suitable for all kinds of markets out there. That’s why we need to determine which markets to hit before the release. Below, we will discuss some ways to find out which markets will be the best for your particular solution.

Market sizing

Knowing how many potential customers can be interested in your product is crucial to choosing suitable promotional activities. That’s what the marketing sizing exercise is for. It can be a part of your strategy planning because it helps predict what kind of revenue can be expected, find out if the product is worth investing in and prepare adequate advertising to reach out to the target audience. It’s also an excellent way to estimate how big of a team will be needed to create the product and optimize production and marketing costs.

Before you begin the exercise below, you should count all the people within your target group, meaning consumers that are being included in your region and the sociodemographic groups you are interested in. You can do that by pulling off statistics from local and global databases (for example, Eurostat). Having a concrete number of people is crucial to defining market share for you and your competition.

Here are the steps to take when you want to establish your market size:

Ask yourself what your target market is

Creating a persona could be the best way to do that. You want to know who exactly will use your product. These people have a particular problem that you have to solve. Also, think about how you will find them. If access is difficult or expensive, it might not be worth it because it will consume the majority of your budget.

You might realize at one point that there is more than one group you want to sell your product to. Analyze them separately, and if one seems more important than others, maybe you should focus on it entirely. Check out the pros and cons of different approaches to maximize profit. Then, look for data that will showcase how big is the group you want to offer your product to.

Evaluate the level of interest

It’s evident that having a promising target audience does not guarantee everyone in it will buy your product. Now you have to make sure what is the actual level of interest. Start with evaluating your competition. How big is their market share? What kind of profit do they gain yearly from selling a similar solution to yours? Unless your biggest competitors focus on multiple markets, information like that will definitely be insightful and helpful.

Another well-known method is running focus groups, as well as conducting surveys and interviews. Asking the right questions to a significant sample of people or companies that might be interested in your offer will give you tons of data you’ll need to segment the market. Try to find as many people as possible to answer you and then draw conclusions.

Estimate the potential profit

This is the moment when you can realistically assess your situation and decide if your product is worth investing in it or not. Using data collected during step two, calculate how much money you can make by selling your product to a target group interested in your product. Remember that even focus groups and interviews won’t give you 100% accurate information, as people sometimes express more excitement than they actually feel. Some respondents can also change their minds in the meantime.

Still, even if you consider that, you can more or less tell what revenue you can get. Compare it with the investment you have to make to create and promote your solution. If the cost of production is significantly lower than potential profit, you can expect low risk, even if not everyone from your target group will buy what you offer them. However, when the risk seems high, it’s better to look for another target group or change a strategy to lower your product’s investment rate.

The Value Net Model

Now let’s talk about stakeholders. Every company has several groups to address: customers, suppliers, competitors, investors and more. Of course, the first one is the most important, but you have to balance your activities to be in touch with all of them. With the Value Net Model, you can predict the behaviors and expectations of all involved parties. It supports the decision-making processes for your business.

According to this model, there are four groups that a company is interdependent from:

- Customers – obviously, these are people who buy your product

- Suppliers – people that provide resources to create your product, can be external organizations or internal employees

- Competitors – companies that offer similar products and take some market share

- Complementors – parties that provide a product or service that supplement your solution

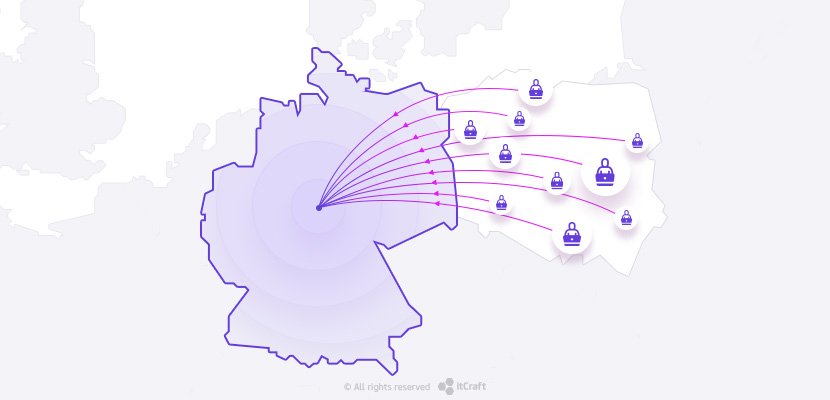

Looking at the image above, you can see that all these groups are somewhat connected. Vertical and horizontal placements also matter. For example, suppliers provide materials to create a product made by the company and delivered to customers. We know that customers are crucial to our businesses, but many entrepreneurs neglect the importance of other relations. Strategies are built based on competition analysis, but often they ignore chances provided by complementors. This knowledge can improve your plan as you stop ignoring certain spots and focus on all possible stakeholders.

Understanding the perspectives of each group can help you find new ideas and improve your activities regarding production, but also promotion. You can put your company in the middle of the model and change perspectives by centralizing other parties. This way, you will discover opportunities that might be missed if you only focused on your business and customers.

Sometimes, stakeholders can be placed in more than one group. For example, competitors can be complementors if you can cooperate to gain profit for both their company and yours.

Using the Value Net Model in practice

The creators of this methodology thought of the PARTS acronym that stands for: players, added value, rules, tactics and scope. These are the five steps that can be taken in the Value Net Model. Let’s take a closer look:

Step one: Identifying players

Divide all people and organizations into groups included in the model. Remember that you are also a player. Then, think about cooperation opportunities, competition, benefits you can gain from each group and possibilities to join forces with some of them. Will someone pay for a partnership with you? Or maybe some companies would avoid it at all costs? You wouldn’t know if you didn’t consider all available options.

Step two: Calculating the added value

Ask yourself: what each of these groups brings to the table? Find out their strong sides and how you can benefit from them. Also, determine your added value by defining unique selling points, finding areas where you can lower costs and increase revenue, analyzing the scalability of your company and listing the ways to improve customer and supplier loyalty. Knowing what each group can offer is essential to maximizing profit.

Step three: Defining rules

Each company is influenced by the general rules of the industry they operate in. You have to know what they are in your niche. Some will be helpful, but others can limit your potential. Maybe there are ways to change some of these rules to offer better service to your customers and other stakeholders? Of course, not everything can be adjusted, but even minor modifications can have a massive impact on your business.

Step four: Identifying tactics

The perception your stakeholders have of your company plays a big role here. That’s why you need to determine the business tactics and optimize them to make even better relations with all involved groups. Is your credibility high among customers and suppliers? Is it easy for your competitors to predict your upcoming moves? Are your communication activities straightforward or complex? How much do you spend on your marketing? Answers to these questions are yet another method to discover areas that can be improved.

Step five: Defining the scope

In other words, founding boundaries of your market. Maybe you can connect with other markets and reach out to more potential customers? Find out if there are any links that you can explore and if it’s worth it. If it is possible, why not explore other options outside your target market? With all the information you gathered in the previous steps, you will know exactly what you and your stakeholders need.

Market segmentation

Last but not least, there’s market segmentation that helps to address the different needs of your customers. It supports your marketing actions because you know exactly who you are talking to and what you must communicate to sell your product and achieve success. Every person has different needs, and various messages will speak to them. You need to prepare the segmentation to know who your audience is.

When working on your market segmentation, the first thing you want to do is divide customers into groups of similar interests and expectations. Suppose you have several groups you wish to address. In that case, you can differentiate approaches and offer them suitable services to ensure each customer is satisfied with the product and gets what they really want. It’s apparent that you advertise differently to college students, parents and seniors, right?

Think about the characteristics of your market segments. Are the groups you have in mind accessible, and if yes, how? Can you estimate the size of each group to divide the marketing budget accordingly? Is the group substantial enough to be relevant for you? Will your potential customers be able to afford your product AND want to pay for it?

When you establish all that, you will know a lot about your market segments.

Now you can divide them based on several factors:

- Geographical: languages, countries, states, cities, neighborhoods

- Demographic: age, gender, occupation, income

- Psychographic: lifestyle, values, interests

- Behavioral: brand loyalty, purpose to use the product, benefits from using the product

These are very broad, though. Remember to divide the market into much smaller and more detailed segments because nowadays, people within the above groups can vary significantly. When you have the primary groups, try to analyze them more. Ask questions we mentioned above and add detail to your potential target audience. This way, your marketing activities will be more on point.

If you run an established business, you can check out your previous statistics and perform market segmentation for a new product based on that. Big corporations do that all the time. Product recommendations based on prior purchases or few versions of electronics for different types of customers can be examples of such a strategy. Everything depends on your goals and also resources.

To sum it up

With all the information from this article, you will know exactly how your product should be built, and you will prepare a flawless marketing strategy suitable for the market you want to conquer. If you are following our product/market fit series, you also know what the product is. In the upcoming episode, we will discuss fitting them both together. We invite you to be up-to-date with our blog to not miss any articles from the series and in general. You will find tons of practical knowledge here.

And if you have a product idea and want to become the next hit in your niche, don’t hesitate to contact us. We will help you establish market segmentation, build a software product of your dreams and support your marketing activities. With us, you get the complete package of services for achieving success in the digital world. Contact our consultants and tell them what you have in mind. Let’s build something extraordinary together!